How to Freeze and Unfreeze Your Credit Report and Why You Need To

Everyone should have a freeze on their credit reports. Let’s dig into the details on both what is a credit freeze and why is it so important.

As many found out after the massive Equifax data breach of 2017, it’s no longer an option to manage your credit report passively. Although many companies allow you to monitor your FICO score and overall credit report, the best way to protect your credit report and overall identity is by placing a Freeze on your credit file.

What Is a Credit Report Freeze?

Each time you apply for credit of some sort, the creditor will pull a credit report against you to get an accurate picture of your credit history. They want to know what your FICO score is and if you have a bad or good habit of paying all your bills on time. When the credit check is made, it can hit one or all three primary credit bureaus (for US residents).

When your credit reports are unfrozen, anyone with access to your personal information (both good and bad guys…) can request credit on your behalf. This is primarily how identity theft occurs — a bad actor pretends to be you and applies for a new source of credit like a credit card. Because they have all of your personal information, including Name, Address, Social Security Number, and mailing address, the three credit bureaus will review your credit file and approve the credit request based on your current rating.

However, if you have a credit freeze in place with all three credit bureaus, no new requests for credit will be approved, even if they have all of your private information. The good news is, setting up a credit freeze is free. Just follow the steps below for all three major credit bureaus.

How to Freeze Your Experian Credit Report

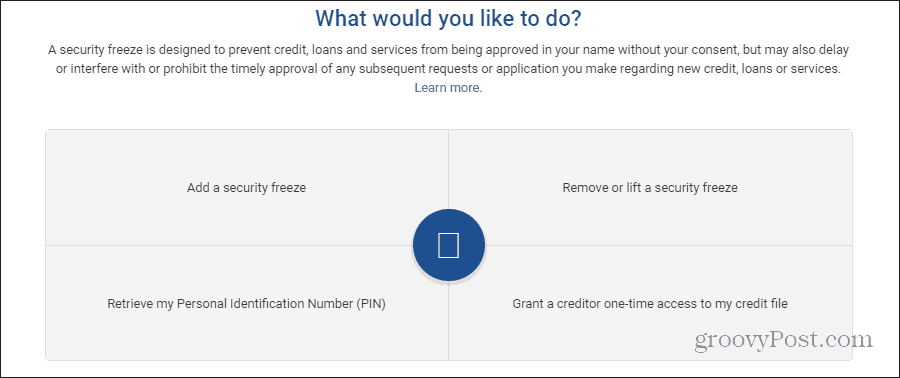

Experian offers a Security Freeze Center page where you can manage your Experian security freeze.

If you don’t have a security freeze yet, select Add a security freeze. On the next page, select Freeze my own credit file.

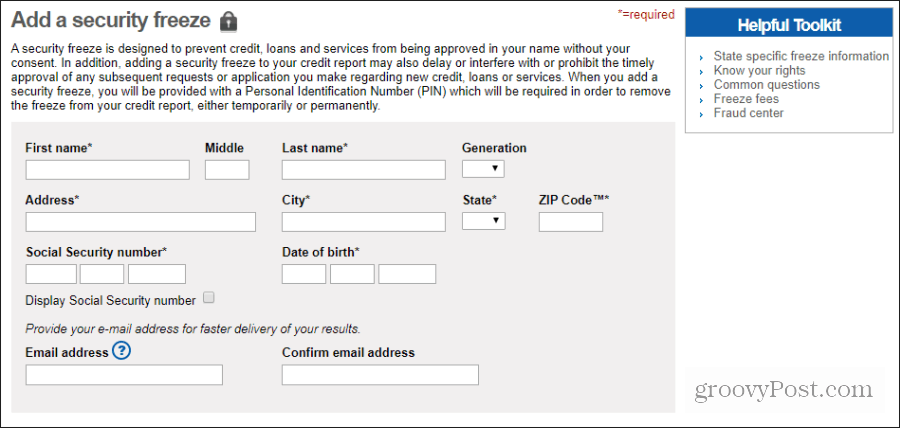

On the next page, you’ll need to fill out a similar form that you had to fill out for Equifax. Fill in your name, address, social security number, date of birth, and email address. At the bottom, you can select your own PIN.

Once you select Submit, you’ll see a confirmation that your security freeze with Experian is active. Remember to write down the PIN and email address you used in a safe place. My personal recommendation is to use a password manager to create a secure note with this information.

How to Unfreeze Your Experian Credit Report

Once the credit freeze is in place, if you ever need to apply for credit yourself, you will need to create a temporary freeze removal.

Start by visiting the same Experian Security Freeze Center page. This time select Remove or Lift a security freeze.

You’ll need to fill out a similar form with the same information. At the bottom, you can type the start and end dates for your security freeze lift.

Select Submit, and once you provide the PIN, you’ll see a confirmation that your temporary security freeze lift is active.

How to Freeze Your TransUnion Credit Report

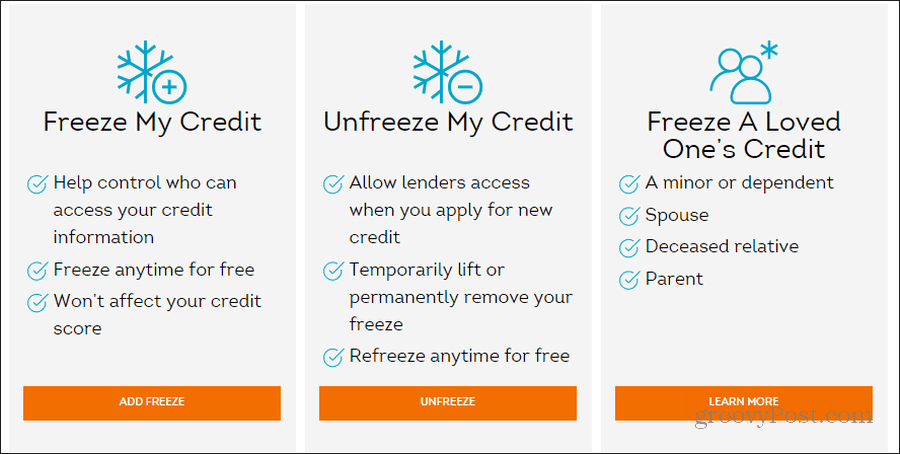

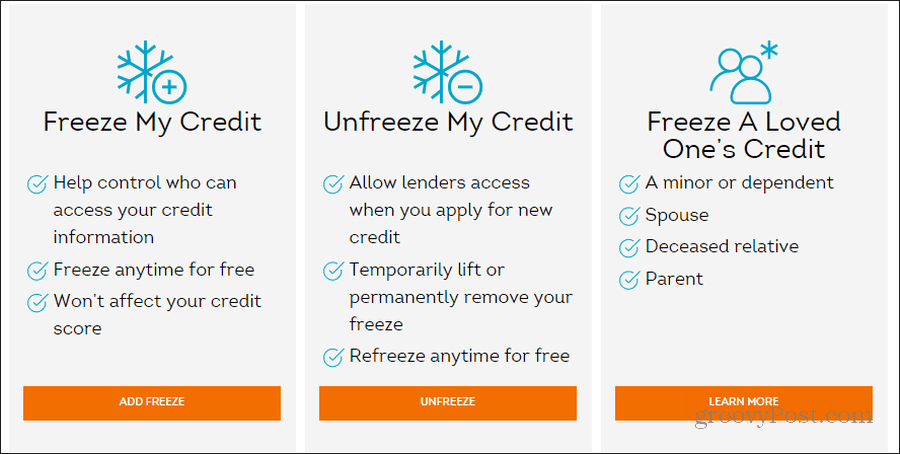

TransUnion offers its own Credit Freeze page. If you haven’t frozen your credit yet, select Add Freeze under Freeze My Credit on this page.

You’ll need to once again fill out the same type of information as with Experian. However, TransUnion allows you to easily create an account with their freeze system, which allows you to lock and unlock it in the future.

But, to freeze your credit for the first time, fill out the form and select Submit & Continue to Step 2. Step 2 is where you create your login details, and Step 3 is where you verify your identity through your email.

You’ll receive a confirmation that your TransUnion security has been frozen and the PIN that you’ll need to save in a safe place.

How to Unfreeze Your TransUnion Credit Report

If you need to unfreeze your credit report with TransUnion to apply for new credit, return to the Credit Freeze page and log in using the account details you were provided.

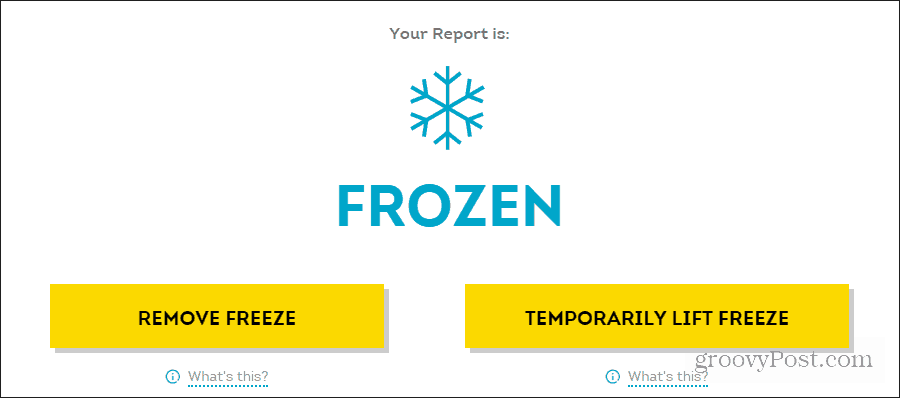

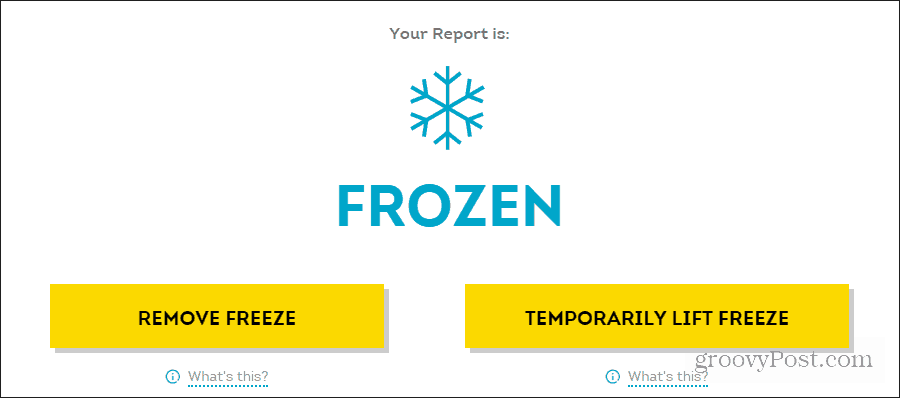

When you log in, you’ll see the status as Frozen. Select the Temporarily Lift Freeze option.

On the next screen, you’ll see a simple form where you need to type the Start Date and the End Date for the security freeze lift.

Select Continue, and you’ll see a confirmation with the date range you’ve requested.

How to Freeze Your Equifax Credit Report

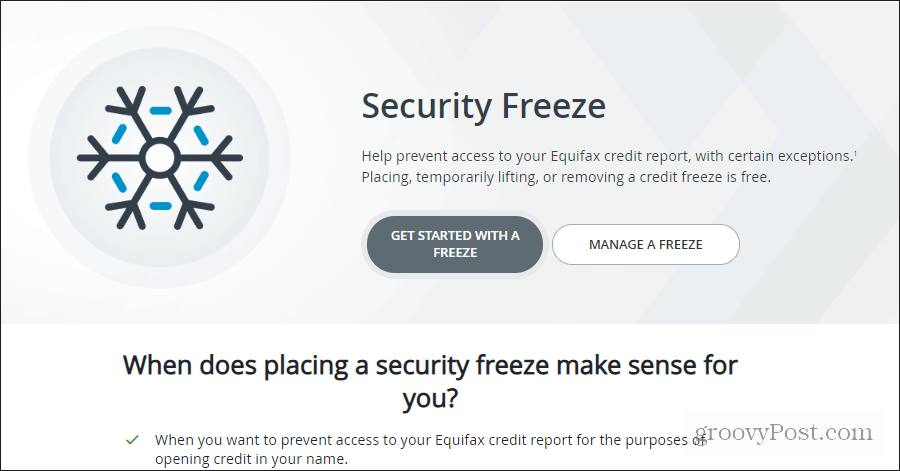

Equifax provides a page on their site tailored to help you manage a security freeze on your account.

If you haven’t set up a security freeze yet, you’ll want to select Get Started With A Freeze. You’ll need to fill out a form, including your name, date of birth, social security number, phone number, and address. All of this information will be checked against your actual credit report to ensure it all matches.

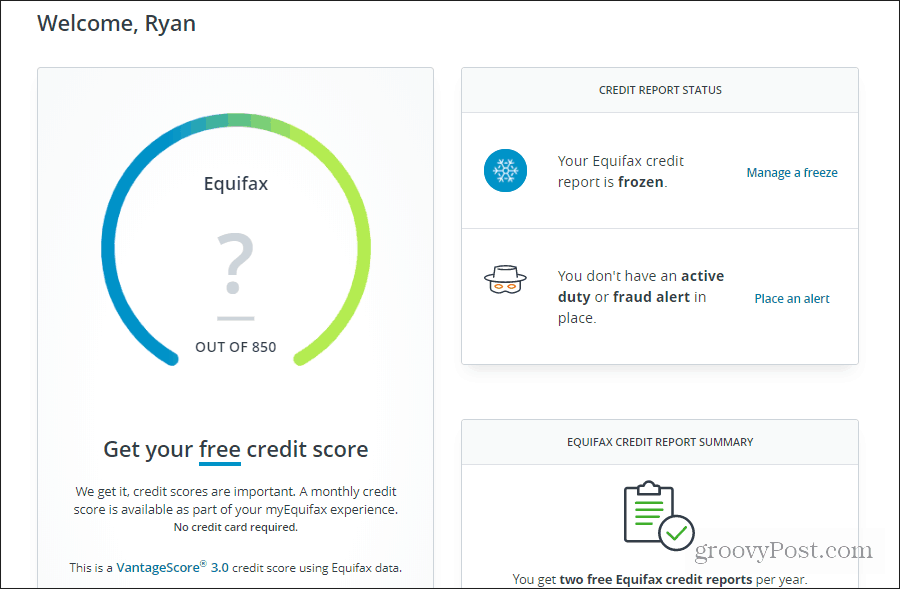

At the confirmation of your credit freeze, Equifax will provide you with an account for their website and a PIN you can use at any point to unfreeze your credit report. Keep this PIN in a very safe place, and don’t lose it, or unlocking your credit report will be extremely difficult.

How to Unfreeze Your Equifax Credit Report

Once you’ve gone through the process to place a freeze on your Equifax report, you can return to this page at any time to temporarily unfreeze the report. You’ll want to do this before you apply for credit anywhere.

To do this, on the same web page, select Manage a Freeze.

You can fill out the same form as above to access your report with your social security number. Or you can sign in using the credentials you were provided when you first froze your credit report. If you use your sign-in credentials, you won’t need your PIN.

Select Manage a freeze to access the process to permanently remove a credit freeze or temporarily. At the bottom of the page for Step 1, you’ll see two options for managing your security freeze.

- Temporarily lift a Security Freeze for a specified Date Range.

- Permanently remove a security freeze.

Select the option to put a temporary lift in place and select the option to accept the Terms of Use. Select Next to continue.

On the next page, set the date range where you’d like to keep the security freeze lift active.

Once you select Submit, you’ll see a confirmation that your security freeze lift is activated.

Concluding Points…

Although freezing your credit may look like a lot of work, it’s actually straightforward and takes only a few minutes. However, I cannot stress enough the importance of keeping track of your accounts in a secure location. Our recommendation here at groovyPost is to use the Password Manager 1Password.

It’s impossible in the digital world to keep track of all your passwords and PINs, and even accounts. That’s where 1Password comes in. When you use it to create accounts, it keeps track of all the details, including suggesting strong passwords vs. weak dictionary words. After all, what’s the point of spending all this time freezing your credit reports against identify theft if you’re just going to use a simple password which you also use on other accounts online? That’s what hackers hope you will do so they can remove these credit freezes for you…

Lastly, before removing a credit freeze when applying for new credit, ask the lender which agency they pull credit from. This way, you can remove the freeze temporarily from that credit bureau vs. removing it unnecessarily from all three.

The idea is to loosen your credit security only as much as you need and for as little time as you have to.